Third parties are the gears that keep enterprise operations moving – suppliers, MSPs, resellers, cloud vendors, and more. According to Gartner, 60% of organizations manage over 1,000 third-party relationships, and that number keeps climbing as business models grow more digital and distributed.

However, third parties can also come with significant risks. Many vendors, like payroll processors, marketing agencies, or cloud service integrators, need access to internal applications, customer data, or file storage systems to do their jobs. This often includes sensitive information such as employee PII, customer records, or proprietary business data.

These vendors may use credentials issued by your organization (e.g., SSO accounts provisioned for access) or operate with their own service accounts that connect via APIs or integrations. If these credentials are over-privileged, unmonitored, or misconfigured and then compromised by attackers, it can create a direct path into your environment. Even one poorly secured vendor account can open the door to data breaches, ransomware, or privilege escalation.

For instance, cybercriminals might exploit a vendor’s weak security measures to gain unauthorized access to your organization’s systems. This can result in data breaches, financial losses, and reputational damage. Ensuring that third parties maintain stringent identity security practices is critical for protecting sensitive information and your overall identity security posture.

That’s precisely where third-party risk management comes into play. By managing the risks third parties introduce, organizations can protect themselves from various consequences, including loss of customer trust, non-compliance, and financial harm.

What is third-party risk management?

Third-party risk management (TPRM) is the practice of identifying, evaluating, and mitigating risks introduced by external vendors, contractors, and service providers—especially those that connect to your infrastructure or handle sensitive data.. It involves assessing the threats these external entities pose to an organization’s security posture and operations.

Examples of third-party risks

When third parties connect to your systems, they introduce more than convenience; they significantly expand your potential attack surface and expose your organization to a broad spectrum of risk. These include financial, environmental, reputational, and cybersecurity threats, particularly when vendors are granted access to intellectual property, sensitive data, personally identifiable information (PII), or protected health information (PHI).

Whether it’s a supplier with weak password practices or a SaaS vendor with excessive entitlements, a single misstep can lead to system downtime, data breaches, or costly compliance violations.

Here are some of the common types of third-party risks to evaluate:

- Cybersecurity Risk: Exposure to threats from cyberattacks, security misconfigurations, or breaches within the third party’s environment.

- Legal, Regulatory, and Compliance Risk: Non-compliance with data protection laws like GDPR or HIPAA due to a third party’s actions or negligence.

- Operational Risk: Disruption to business operations caused by service outages or vendor performance issues.

- Reputational Risk: Damage to brand trust or public perception resulting from a vendor’s incident or misconduct.

- Financial Risk: Unexpected costs or revenue losses due to vendor failure or security events.

- Strategic Risk: Falling short of business goals because a third party underperforms or introduces unacceptable levels of risk.

Why is third-party risk management important?

The growing reliance on third-party software, infrastructure, and services makes TPRM a critical pillar of identity and data security strategy.

Here’s why third-party risk management (TPRM) is essential for modern enterprises:

Complexity of information security: Outsourcing boosts scale and efficiency, but many vendors still lack mature security controls. According to SecurityScorecard, 98% of organizations are connected to at least one third-party vendor that has suffered a breach, and 29% of all data breaches are attributable to third-party attack vectors. In 2024 alone, 48% of breaches were linked to vulnerabilities in third-party access, driven by stolen credentials and over-permissioned accounts.

Recent high-profile incidents underscore the trend:

- Ticketmaster (May 2024): Breach impacted ~560 million users

- AT&T (May 2024): Exposure of ~70 million records via a third-party cloud vendor

- National Public Data (April 2024): Massive leak of ~2.9 billion records through a data broker

Expanded attack surface: Every vendor integration—whether SaaS, managed service provider (MSP), or API—creates a new potential entry point for attackers. Even trusted vendors can become risk vectors if access isn’t strictly governed and continuously monitored.

Regulatory and reputational impact: Regulations like GDPR, CCPA, and HIPAA hold organizations accountable for third-party security failures. One vendor lapse can trigger regulatory fines, audits, and long-term brand damage, even if the incident originated outside your perimeter.

Benefits of Third-Party Risk Management

Implementing a comprehensive TPRM strategy is crucial for protecting an organization’s security and operations.

Key benefits include:

- Reduced costs: Proactive risk management helps avoid the steep cost of a data breach, averaging $4.55 million globally in 2023.

- Regulatory compliance: TPRM supports alignment with regulatory standards like FISMA, SOX, HIPAA, GLBA, and the NIST Cybersecurity Framework, which is often a legal requirement, and it also ensures that you stay audit-ready across regions.

- Risk reduction: From onboarding through offboarding, continuous monitoring and risk-based access reviews help reduce exposure to vendor-related breaches and data leaks.

- More visibility and confidence: A structured TPRM program delivers better insight into vendor access, enabling faster, more informed decisions that improve your overall security posture.

Who owns third-party risk management?

Third-party risk management (TPRM) is a shared responsibility across multiple teams—but that doesn’t mean it’s ownerless. While risk assessments, access controls, and vendor oversight are distributed across the organization, most mature programs designate a clear point of accountability to ensure alignment and follow-through.

Depending on the company, that accountability might sit with the CISO, Procurement, Enterprise Risk Management, or Compliance. The title may vary, but the function is the same: to oversee third-party risk holistically, ensure responsibilities are clearly defined, and drive sustained risk mitigation across the business.

The following roles outline how individual stakeholders support the broader strategy, each playing a critical part in protecting the organization from third-party risk.

- The Chief Information Security Officer (CISO) oversees the organization’s broader cybersecurity strategy, including third-party risk, and ensures it’s embedded in security controls and policy.

- Risk Management: Performs detailed vendor risk assessments, tracks specific exposures, and collaborates with other teams to monitor and mitigate ongoing threats tied to third-party access.

- IT and Security Teams implement and maintain technical controls to secure third-party access, conduct security assessments, and manage identity and access controls as part of the overall risk mitigation strategy. These controls often include identity governance administration and user access reviews.

- Procurement and Vendor Management Teams select and onboard third-party vendors, ensuring they meet defined security and compliance criteria before any contracts are signed or access is granted.

- Legal and Compliance Teams ensure third-party relationships adhere to applicable laws and regulations by drafting and enforcing vendor agreements that cover breach notification, data use, audit rights, and regulatory obligations.

- Business units own the relationships with their vendors and ensure they follow agreed-upon security protocols and escalate issues when something doesn’t look right. They must act as a first line of defense for operational risks.

- Internal auditors conduct regular reviews of TPRM processes and controls, providing independent assessments that surface gaps, validate effectiveness, and support continuous improvement.

The CISO, Head of Enterprise Risk/TPRM, or Head of Procurement is typically the ultimate accountable owner for the organization’s overall third-party risk strategy and posture. They set the strategic direction, ensure TPRM is integrated into broader security and risk frameworks, and report on the aggregate risk exposure from third parties.

Ultimately, while accountability for the overall third-party risk posture may reside with one senior leader, the effective management of third-party risk is a truly interdependent effort. The success of TPRM hinges on organization-wide buy-in and clear delineation of responsibilities for specific risk mitigation activities. A single weak link—be it a misconfigured integration, an unmanaged vendor account, or a forgotten access token—can undermine the collective efforts. Therefore, every stakeholder must not only understand their defined role but also actively commit to managing the specific third-party risks under their purview, contributing to the organization’s holistic security.

How TPRM works

The TPRM process involves several key stages from vendor sourcing to offboarding, each designed to mitigate risks, ensure secure access, and strengthen your overall identity and security posture:

Vendor sourcing

The TPRM process begins by identifying potential third-party vendors that align with your organization’s business needs and security requirements.

At this stage, the focus is on selecting vendors with mature security practices, operational transparency, and a proven ability to safeguard sensitive data.

Vendor selection and risk assessments

Once potential vendors are identified, the organization conducts a thorough evaluation process, including detailed risk assessments, to determine their fit.

These assessments review the vendor’s security posture, policies, incident history, and technical controls to flag any gaps that could introduce risk, with the goal of identifying potential vulnerabilities early and moving forward only with vendors who meet your organization’s standards for secure access, data protection, and regulatory alignment.

Onboarding, contracting, and procurement

After selecting a vendor, the next stage is onboarding—this involves integrating the third-party vendor into your organization’s systems and workflows in a secure and controlled way.

This stage also includes drafting and finalizing contracts that clearly outline security requirements, data handling expectations, and access permissions. These contracts often include clauses for compliance with internal and external security standards, incident response protocols, and regular security assessments or audits to ensure ongoing alignment.

Risk monitoring

Continuous risk monitoring is essential to maintaining a secure relationship with third-party vendors. This includes regularly reviewing and assessing the vendor’s security practices to detect changes, identify new risks, and ensure their controls stay effective over time.

Modern tools make it easier to track a vendor’s access to sensitive information, identify excessive or risky entitlements, and catch issues early, before they lead to an incident. While SIEMs or UEBA platforms alert on suspicious activity, access intelligence solutions like Veza provide the upstream context: who has access to what, and whether that access is appropriate in the first place.

Offboarding

When a third-party relationship ends, a formal offboarding process is critical. This ensures that all access to systems, apps, and data is fully revoked, and nothing slips through the cracks. Offboarding includes revoking credentials, API tokens, and entitlements, and confirming that any data shared with the vendor is returned, retained, or securely destroyed based on policy.

Tackling Access Sprawl in TPRM

Third-party risk management doesn’t just hinge on the quality of vendor assessments—it depends on visibility into how access is granted, distributed, and governed across the environment.

In today’s cloud-first world, third-party access isn’t centrally controlled. Instead, it’s scattered across dozens (or hundreds) of apps and systems, each with its own permission model. This phenomenon, access sprawl, makes it difficult for organizations to answer fundamental questions like:

- Who has access to which systems?

- What level of privilege do they hold?

- Can they take action on sensitive data?

This lack of visibility introduces a real security risk. Most teams can secure the “front door” with strong onboarding policies or SSO integration. But identity risk often enters through the side door via misconfigured permissions, unmonitored service accounts, or vendor entitlements that quietly persist long after they’re needed.

Before implementing best practices, organizations need to confront access sprawl directly. Without a unified view into who can do what with your data, across SaaS, cloud, and on-prem systems, true third-party risk governance remains out of reach.

Third-party risk management best practices for a stronger security posture

Effective third-party risk management (TPRM) is essential for maintaining control over identity security, especially as third-party access becomes more distributed, dynamic, and difficult to govern.

Today’s identity programs face multi-dimensional challenges when it comes to third-party users:

- Identity governance and provisioning is more difficult without a centralized source of truth for third-party identities.

- Technology and integration efforts become strained when managing access across multi-cloud and legacy systems.

- Access control and security can break down when shared or overly permissive accounts go unmonitored.

- Compliance and auditing remain difficult due to fragmented logging, stale accounts, and the complexities of demonstrating policy adherence.

These compounding issues require a disciplined, strategic approach to TPRM. The following best practices offer a blueprint to reduce risk, improve operational rigor, and reinforce your organization’s overall identity security posture.

Create a third-party risk framework

Establish a formal TPRM framework grounded in recognized standards such as NIST, ISO 27001, or PCI DSS. This framework should guide how your organization assesses vendor risk, monitors third-party access, and responds to emerging threats. Keep it current with evolving regulations and industry best practices.

Implement standard onboarding and offboarding processes

Standardize onboarding and offboarding workflows to ensure consistency and control. During onboarding, clearly communicate security requirements and access expectations. At offboarding, confirm access has been revoked and all shared data is either returned, retained, or securely deleted—no loose ends.

Monitor access in real time

Leverage tools that continuously monitor third-party access across systems and environments. The closer to real-time visibility you can get into entitlements and permissions, enables earlier detection of risky access and faster response to potential issues.

Check and manage permissions effectively

Review and update access permissions regularly, implementing the principle of least privilege to minimize security risks. Ensure vendors have only the necessary access for their functions, reinforcing strong access governance.

Work with third-party risk management software solutions

Invest in software platforms that support automated vendor risk assessments, access monitoring, and audit-ready reporting. These tools help streamline third-party oversight and uncover risks that often slip through manual reviews, particularly in complex, multi-cloud environments. Access intelligence solutions, including those that map permissions across systems and flag misaligned access, can further strengthen your TPRM program.

The Overlooked Third Party: Everyday SaaS

Third-party risk doesn’t just come from large vendors with formal onboarding processes and contracts. Sometimes, the riskiest vendors are the ones hiding in plain sight: collaboration tools and SaaS platforms that have become part of the daily workflow.

Think Slack. Zoom. Asana. GitHub. Teams. Notion.

They’re everywhere. These apps power productivity, connection, and delivery across the org. But they also hold sensitive content: intellectual property, roadmap docs, financial conversations, production code, and more.

Even when properly procured and approved, these tools often fall into a blind spot when it comes to identity and access risk:

- Admin accounts with elevated privileges are rarely reviewed.

- Shared access and integrations with other apps (like Google Drive, Jira, Salesforce) increase the blast radius.

- Offboarding often fails to fully revoke access for contractors, external collaborators, or dormant accounts.

In many cases, these SaaS platforms integrate directly into your SSO or cloud identity provider, creating service accounts or assigning roles that persist quietly in the background. Without centralized visibility into these entitlements, risky access can build up fast.

In both North America and the EU, regulators increasingly expect continuous oversight of how vendors handle data, not just a checkbox during onboarding.

That’s why TPRM can’t stop at procurement gates or vendor lists. If a third party has access to your data, whether through APIs, admin dashboards, or silent integrations, it’s part of your risk surface. And that means it needs to be visible, governed, and regularly reviewed, just like any other access in your environment.

Third-party risk management trends to look out for

Keeping pace with trends in third-party risk management is key to staying ahead of threats and tightening your overall identity security posture.

Key trends to watch include:

- Growth in risks: As organizations lean more on external vendors and SaaS platforms, the risk surface grows. Each new integration introduces potential exposure points, and attackers are increasingly exploiting these indirect paths, targeting smaller vendors to reach bigger fish.

- Higher regulatory fines: Regulatory bodies are imposing stricter penalties for data breaches and non-compliance with data protection laws. Global data protection laws hold organizations accountable for the actions of their third-party vendors. Failure to manage third-party risks effectively can result in significant fines and reputational damage.

- Usage of artificial intelligence (AI) and machine learning (ML): AI and ML are becoming increasingly integral to TPRM. These technologies can improve risk assessment and monitoring processes by analyzing vast amounts of data to identify patterns and anomalies that might indicate potential security threats. AI-driven tools can automate the continuous monitoring of third-party activities, providing real-time insights and alerts that help organizations respond swiftly to emerging risks. The use of AI and ML in TPRM is expected to grow, offering more sophisticated and efficient risk management capabilities.

- Emphasis on continuous monitoring: Continuous monitoring of third-party vendors is becoming a standard practice. Rather than relying solely on periodic assessments, organizations are adopting tools and technologies that provide ongoing visibility into vendor activities and security practices. Continuous monitoring helps identify and mitigate risks in real time so security controls can stay effective throughout the vendor relationship.

- Integration of zero trust principles: Zero trust security principles are increasingly integrated into TPRM strategies. The Zero trust model operates on the assumption that threats can exist both inside and outside the network, and therefore, no entity should be trusted by default. In the context of TPRM, this means continuously verifying the identity and security posture of third-party vendors, regardless of their access level or location.

- Increased focus on supply chain security: A breach in one vendor can have cascading effects throughout the supply chain. Organizations are placing greater emphasis on assessing and securing their entire supply chain, ensuring that all third-party vendors adhere to stringent security standards.

Improve your third-party risk management

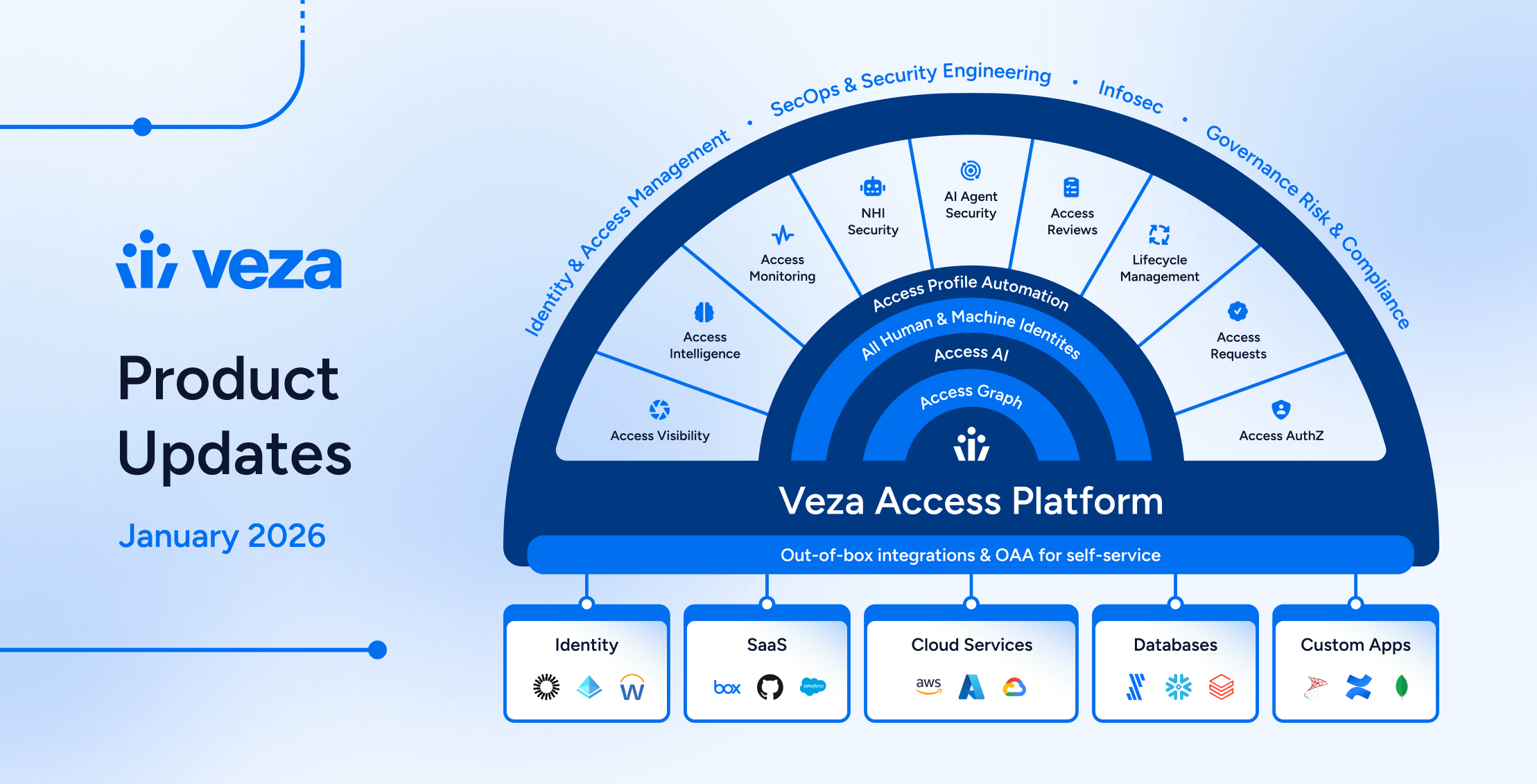

Effective TPRM is non-negotiable for protecting your organization in today’s increasingly complex business environment. With Veza, you can significantly streamline third-party risk management by transforming how you manage access control and permissions for digital identities.

By capturing access metadata from all enterprise systems and visualizing it using an interactive graph, Veza helps you understand who can take what action on what data, including third-party vendors.

Veza enables secure access governance across your environment for both human and non-human identities by connecting to any business system. That way, you can monitor all identities, enforce least privilege, translate complex permissions into business-friendly language, and automate issue detection and remediation.

If you’re just beginning to evaluate third-party risk in SaaS platforms like Slack, Zoom, or Teams, start with our SaaS Security Posture Management (SSPM) overview, where we break down how access sprawl in everyday tools often goes unchecked.

Already on the path to tighter access controls? Our Access Intelligence Data Sheet offers a deep dive into how Veza’s platform continuously monitors permissions, flags over-privileged identities, and keeps your systems audit-ready.

Ready to see Veza in action? Schedule a demo to explore how our access intelligence solution can help you operationalize identity-first TPRM across your enterprise.

About the Contributors

This article was written in collaboration with Mariah Brooks, Matthew Romero, and Michael Towers, bringing multiple perspectives to third-party risk management.

Mariah Brooks is an independent consultant and researcher focused on identity governance, cyber risk, and responsible AI, and provided the foundational insights for this article. Her work brings clarity to complex security challenges through an objective, vendor-neutral lens.

Matthew Romero, Technical Product Marketing Manager at Veza, translated these insights into actionable guidance for security teams, aligning the content with the operational realities and strategic demands of modern identity security.

Michael Towers, Chief Security & Trust Officer at Veza, contributed strategic oversight and real-world expertise, enhancing the article’s technical accuracy and relevance for senior security professionals navigating today’s complex threat landscape.

Connect with the authors:

Mariah Brooks | Matthew Romero | Michael Towers