Protecting organizations’ financial information from cyberattacks, insider threats, and security breaches is becoming increasingly challenging. In 2023 alone, there was a 72% increase in data breaches compared to 2021. As security incidents continue to grow in frequency and severity, organizations must secure their financial and other sensitive data to avoid the financial and reputational consequences of a cyberattack.

But for some companies, protecting this information isn’t simply important for good business practices—it’s mandatory.

Under the Sarbanes-Oxley (SOX) Act, publicly-traded organizations must prove they have the appropriate internal controls in place to ensure accurate financial reporting, protect sensitive financial data, reduce the risk of fraud and insider threats, and improve auditability and accountability. Although complex, SOX compliance is required for all publicly traded companies in the U.S., and understanding its nuances is important not only to comply but to proactively shape the future of cybersecurity.

This guide explores the ins and outs of SOX compliance, including who must comply, the benefits and challenges, best practices, and a comprehensive checklist so your business can get SOX compliant as quickly as possible.

What is SOX compliance?

Maintaining SOX compliance requires implementing the appropriate procedures to meet the Act’s specific requirements, such as maintaining financial records, establishing internal controls, conducting regular audits, and protecting against data tampering.

This United States federal law was created to protect investors by improving the accuracy and reliability of corporate disclosures. It was enacted in response to several significant financial scandals involving large corporations that damaged investor trust.

Ultimately, the goal of SOX compliance is to foster transparency, reliability, and accountability in corporate financial practices to protect the interests of investors and the general public. It also includes provisions for whistleblower protection to encourage employees to report fraudulent activities or violations of securities laws without fear of retaliation. Specifically, Section 806 protects employees who report misconduct from retaliation by their employers.

SOX compliance is particularly important for public companies, especially those traded in the U.S. or international companies doing business in the U.S. Non-compliance can lead to severe penalties, including fines of up to $1M and ten years of imprisonment for executives. Additional penalties for executives who “willfully” certify noncompliant financial reports include up to $5M and 20 years imprisonment.

SOX compliance example

To comply with SOX, a publicly traded company must maintain and securely store all financial records, such as sales, purchases, payroll, and tax information, for seven years.

The organization should implement internal controls over financial processes, like automated systems requiring multiple approvals for significant transactions and cross-checking invoices with purchase orders and delivery receipts. Regular internal and external audits are also necessary to evaluate these controls and financial report accuracy.

Finally, the CEO and CFO must certify the accuracy of financial statements, ensuring compliance with SOX and reinforcing accountability to maintain investor and public trust.

A Brief History of SOX (Sarbanes Oxley)

The Sarbanes-Oxley Act was enacted on July 30, 2002, in response to a series of high-profile financial scandals that shook investor confidence in the early 2000s. Notable cases involving companies like Enron, WorldCom, and Tyco exposed significant fraud and corruption in corporate America. Unfortunately, these incidents put investors at risk due to misleading or fraudulent financial reporting.

Ultimately, SOX was designed to help mitigate these risks by improving corporate governance and reporting accuracy. It introduced reforms to improve transparency, establish internal controls, require independent audits, and hold top executives accountable. One key provision of SOX, Section 906, is that senior corporate officers must personally certify the accuracy of financial statements so they are directly responsible for any misconduct.

Over twenty years later, SOX is widely regarded as a successful legislative measure. Since its creation, incidents of financial fraud have decreased significantly, and investor confidence in accountability has grown. Its rigorous assessments have helped companies uncover hidden issues and areas for improvement that could only come to light through such an in-depth analysis.

Who must comply with SOX?

Today, all publicly traded companies in the U.S., including foreign companies, must comply with SOX. This also includes their subsidiaries and the accounting firms that audit them.

Publicly-traded companies

Under SOX, all companies listed on the U.S. stock exchanges must ensure the accuracy and reliability of their financial reporting to potential investors.

Additionally, sometimes nonprofits and charities are required to comply with SOX regulations. The Act also makes it illegal for any public, private, or nonprofit organization to destroy or falsify financial records to obstruct a federal investigation.

Wholly-owned subsidiaries

Wholly-owned subsidiaries of publicly traded companies must comply with SOX as long as their financial information is included in the parent company’s consolidated financial statements.

Private companies preparing for IPOs

Private companies planning to go public through an Initial Public Offering (IPO) must comply with SOX before listing.

Accounting firms that conduct SOX audits

Accounting firms that conduct audits of publicly traded companies must comply with SOX regulations. These firms are overseen by the Public Company Accounting Oversight Board (PCAOB).

To ensure the integrity of their audits, they must adhere to strict auditing standards like the generally accepted auditing standards (GAAS).

International companies registered with SEC

International companies registered with the U.S. Securities and Exchange Commission (SEC) must comply with SOX. This requirement applies to foreign firms with publicly traded securities on the US stock exchanges.

Despite being based outside the United States, these companies must follow the same stringent standards for financial reporting and internal controls as their domestic counterparts.

Benefits of maintaining SOX Compliance

SOX compliance has many advantages for organizations, particularly when it comes to improving identity security and protecting sensitive information.

Improved financial accuracy & reporting

One of the primary benefits of SOX compliance is improving financial accuracy and reporting. By implementing identity security measures and thorough auditing processes, companies can make sure that only authorized users have access to financial systems.

This can help reduce the risk of unauthorized changes to financial data and ensure that financial statements are accurate and reliable. Ultimately, this can build trust with investors and facilitate better decision-making by giving stakeholders a clear and honest view of the company’s financial health.

Prevention of fraud

SOX compliance can also significantly reduce the risk of fraud by enforcing strict access governance requirements. Because SOX requires regular audits and thorough monitoring of user activities, it’s easier for organizations to identify and mitigate potential fraudulent activities before they cause harm.

By fostering a culture of transparency and accountability and ensuring that access to financial data is tightly controlled, SOX compliance helps organizations detect and prevent fraud to protect their assets and reputation.

Reduced legal risk

Following SOX requirements can also minimize legal risks by ensuring measures are in place to prevent unauthorized access and data breaches. Non-compliance with SOX can result in severe penalties, including fines and imprisonment for top executives.

Organizations can avoid these legal repercussions by maintaining compliance and demonstrating their commitment to upholding high ethical standards. This protects the company from legal issues and improves its credibility in the eyes of regulators and investors.

Streamlined operations

SOX compliance can also help streamline operations. Establishing and maintaining internal controls often uncovers financial system and procedure inefficiencies and redundancies. Addressing these issues can optimize operations, reduce costs, and improve efficiency. Ultimately, this can contribute to a more agile and responsive organizational structure.

Standardized processes

SOX compliance also encourages the standardization of processes across the organization. Standardized procedures for financial reporting and internal controls ensure consistency and reliability in operations. This uniformity simplifies audits and reviews and facilitates better communication and coordination.

Standardized processes help maintain high levels of accuracy and efficiency, ultimately contributing to long-term success.

SOX compliance checklist

The following checklist outlines several key areas companies should focus on to comply with SOX.

1. Financial & security reporting

Ensuring accurate and comprehensive financial and security reporting is essential for SOX compliance. This involves:

- Preparing accurate financial statements and disclosing the effectiveness of internal controls over financial reporting.

- Promptly disclosing any significant changes in financial condition or operations and reporting security incidents affecting financial reporting.

- Regularly reporting the audit committee’s activities and having the CEO and CFO certify the accuracy and completeness of financial statements and disclosures.

2. Security breach monitoring & responses

Effective monitoring and response to security breaches are critical components of SOX compliance. Organizations must implement systems to detect, document, and respond to security incidents that could impact financial data integrity.

Key actions include:

- Deploying advanced tools for continuously monitoring network traffic, system logs, and user activities and implementing intrusion detection systems (IDS) to identify and respond to unauthorized access in real time.

- Maintaining detailed access logs that record all attempts to access sensitive financial and IT systems, tracking both human and non-human identity management. This includes user information, time of access, and activity details.

- Thoroughly documenting all security incidents, including breach details, affected systems, response actions, and outcomes–and then providing these reports to SOX auditors.

- Conducting regular training sessions on security awareness and incident reporting procedures to ensure all employees understand their responsibilities.

3. IT general controls

IT general controls (ITGC) are essential for ensuring financial data and systems’ integrity, security, and reliability. These cover:

- Implementing strict user access reviews to enforce the principle of least privilege, using strong authentication mechanisms like multi-factor authentication (MFA), and regularly reviewing logs to detect unauthorized access or unusual activity.

- Developing and enforcing formal change management processes, maintaining detailed records of all changes, and ensuring duties are segregated to avoid conflicts of interest.

- Conducting regular system maintenance, monitoring IT system performance, and establishing incident management procedures, including maintaining an incident log and performing root cause analyses.

4. Data storage & restoration

Secure data storage and reliable restoration are critical for maintaining SOX compliance. These practices protect financial data from loss, tampering, and unauthorized access while ensuring data availability when needed. They include:

- Implementing encryption for data at rest and in transit, enforcing strict access controls, and using redundant storage solutions to protect against unauthorized access, breaches, and data loss.

- Conducting regular data backups, validating backup systems to ensure data can be restored, and storing backup data offsite to protect against localized disasters.

- Developing and testing detailed procedures for data restoration, ensuring processes work effectively, and performing integrity checks to verify the accuracy of restored data.

- Implementing audit trails to track data changes, regularly reviewing them to detect unauthorized alterations, and using data integrity tools to monitor and verify data consistency and accuracy.

5. Implementation & verification of safeguards

Safeguards protect financial data and ensure the integrity of internal controls and include:

- Conducting risk assessments to identify potential threats, implementing appropriate safeguards, developing security policies and procedures, and deploying up-to-date solutions like firewalls and anti-malware software.

- Conducting regular internal and external audits, testing internal controls, and continuously monitoring the effectiveness of safeguards through automated tools and manual reviews.

- Maintaining transparency with SOX auditors by providing detailed documentation of safeguards and verification results and preparing comprehensive compliance reports summarizing the effectiveness of safeguards and corrective actions taken.

- Establishing feedback mechanisms to gather input from employees and auditors and regularly update safeguards based on industry best practices, technological advancements, and emerging threats.

6. Proper documentation

Proper documentation is a cornerstone of SOX compliance, ensuring transparency, accountability, and traceability of financial and security activities. Effective documentation practices include:

- Maintaining detailed records of all financial transactions and preparing comprehensive financial statements, including balance sheets, income statements, and cash flow statements.

- Keeping meticulous logs of all access to financial systems and sensitive data and documenting all security incidents, detailing the nature of each incident and the response actions taken.

- Maintaining thorough records of all changes to IT systems and applications, including change requests and approvals, and documenting the results of tests conducted on internal controls, noting any deficiencies and corrective actions.

- Recording the findings of risk assessments, preserving copies of internal and external audit reports, tracking the implementation of recommendations, and documenting follow-up actions.

- Documenting any safeguards or internal controls failures, including root cause analysis and corrective actions taken, and keeping records of continuous improvement efforts, such as policy revisions and training programs.

Best practices for maintaining SOX compliance

Maintaining SOX compliance is an ongoing process that requires diligent effort and strategic planning. The following best practices can help organizations comply with SOX and improve their financial integrity and security measures.

Perform SOX risk assessments

Conducting SOX risk assessments is essential for identifying potential threats to financial reporting and internal controls. These assessments help organizations understand where vulnerabilities exist and prioritize areas for improvement. By systematically evaluating risks, companies can implement targeted controls to mitigate these risks effectively.

Ensure availability and accuracy of SOX documentation

Accurate and readily available documentation is crucial for SOX compliance. Organizations should maintain comprehensive records of financial transactions, access logs, security incidents, control testing results, and audit reports. This documentation should be easily accessible for review by auditors and internal stakeholders, ensuring transparency and accountability.

Assess the effectiveness of your SOX program

Identifying weaknesses in the SOX program ensures continuous improvement and compliance. This involves conducting internal audits, reviewing control performance, and soliciting feedback from employees and auditors.

Remedy an inadequate SOX program

If assessments reveal deficiencies in the SOX program, immediate corrective action is important. This may involve redesigning controls, updating policies, enhancing training programs, or investing in new technologies.

Promptly addressing issues helps prevent compliance issues and strengthens the overall integrity of the organization’s financial practices.

Look for automation opportunities

Automated tools can streamline access control, transaction monitoring, and documentation management. Automation reduces the risk of human error, ensures consistency, and frees up resources for more strategic tasks.

Continuous SOX monitoring

Continuous monitoring helps detect and address issues promptly, ensuring that the organization remains compliant and responsive to emerging risks. Implement systems and tools that monitor financial transactions, access controls, and security measures.

Control owner training

Ensuring that control owners are knowledgeable and competent helps maintain the integrity and effectiveness of the SOX program. Regular training sessions should cover internal controls, risk management, documentation, and incident response.

Challenges of SOX Compliance

While SOX compliance provides significant benefits, it also presents several challenges that organizations must navigate.

Time-consuming

SOX compliance is often a time-consuming process. Organizations must dedicate substantial resources to documenting financial activities, implementing controls, conducting audits, and maintaining accurate records. Continuous monitoring and updating of compliance measures require ongoing attention, which can be demanding for staff and management.

Compliance requirements complexity

The SOX Act encompasses a wide range of controls and procedures, each with specific standards that must be met. Organizations must ensure they understand and correctly implement all relevant requirements, which can be challenging without specialized knowledge and expertise.

Frequency of changing regulations

Financial regulatory environments are dynamic, and existing laws are frequently updated and amended to adapt to new financial practices, technological advancements, and economic shifts.

For organizations, this means constantly monitoring these changes and assessing their impact on current compliance practices.

Lack of visibility

Achieving full visibility into all aspects of compliance can be difficult, especially in large organizations with complex structures. Ensuring that all departments and subsidiaries adhere to SOX requirements requires comprehensive systems for tracking and reporting compliance activities.

Without clear visibility, organizations risk missing critical compliance issues.

Additional financial burden

Compliance costs include investments in technology, hiring specialized staff, conducting audits, and continuous training. These expenses can strain financial resources, particularly for smaller organizations, making balancing compliance costs with other business priorities challenging.

More about SOX compliance

Explore some other details of SOX compliance to help organizations better navigate this regulation.

What are the controls of SOX?

SOX controls are designed to ensure the accuracy and reliability of financial reporting and to prevent fraud. These controls can be broadly categorized into several types:

- Internal Control over Financial Reporting (ICFR): These controls ensure the accuracy and integrity of financial reporting at the entity, process, and transaction levels.

- Information Technology (IT) Controls: This includes general IT controls like access controls, change management, operational controls, and security measures, as well as application controls that ensure the completeness, accuracy, and validation of data within specific applications.

- Financial Reporting Controls: These controls ensure timely and accurate SEC filings through disclosure controls and procedures and include CEO and CFO certifications to verify the accuracy and completeness of financial statements.

- Operational Controls: These controls include the segregation of duties to prevent fraud and errors and regular account reconciliation to detect and correct discrepancies.

- Audit Committee Oversight: This involves ensuring the audit committee is independent, oversees external auditors, and monitors the financial reporting process, internal controls, and audits.

- Continuous Compliance and Monitoring: This involves conducting regular internal and external audits to assess control effectiveness and implementing continuous monitoring mechanisms for ongoing SOX compliance and timely detection of deficiencies.

What is the difference between SOC 2 and SOX compliance?

SOC 2 and SOX compliance are both critical frameworks for ensuring organizational accountability and data integrity, but they serve different purposes and have different focuses. The main difference lies in their scope: SOX focuses on the accuracy of financial reporting, while SOC 2 emphasizes data security and privacy.

SOX is primarily concerned with the accountability and reliability of publicly traded companies’ financial reporting. It mandates strict internal controls, financial disclosure, and executive accountability to prevent fraud and protect investors.

SOC 2 (Service Organization Control 2) is a framework developed by the American Institute of CPAs (AICPA) that focuses on the controls related to the security, availability, processing integrity, confidentiality, and privacy of customer data. SOC 2 is relevant to service organizations that handle customer data and must demonstrate their commitment to these principles.

While SOX compliance is legally required for publicly traded companies in the U.S., SOC 2 compliance is voluntary but often necessary for service providers to build trust with their customers and meet contractual obligations.

What does SOX stand for?

SOX stands for the Sarbanes-Oxley Act of 2002. This U.S. federal law was enacted in response to major corporate and accounting scandals, including those involving Enron and WorldCom. The primary aim of SOX is to protect investors by improving the accuracy and reliability of corporate disclosures and to restore public confidence in financial markets.

Stay compliant with SOX requirements

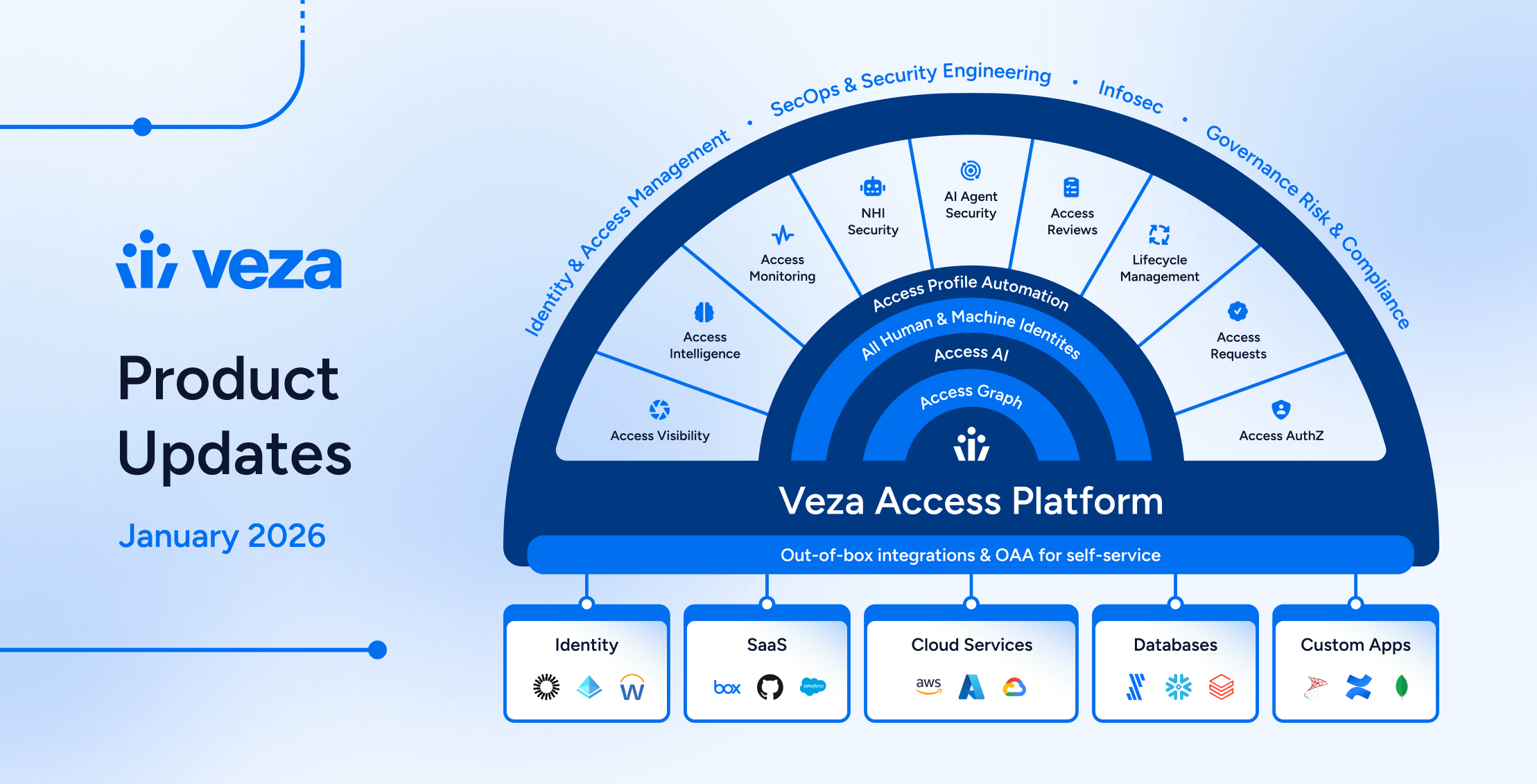

SOX compliance isn’t a one-and-done activity. It requires constant vigilance and solutions that can adapt to your organization’s changes. With Veza, your organization can meet and maintain SOX compliance without manual, time-consuming, and error-prone processes.

This next-gen identity security solution is reinventing access reviews and certifications with automation and access intelligence to help managers make more informed decisions. Veza helps organizations demonstrate compliance with SOX, ISO 27001, SOC 2, GDPR, and more. It can also help you speed up the process by up to 86% with audit-ready access reports.

Veza lets you build queries to scan for access that violates policies required for SOX automatically and even lets you discover local users and local admins created outside the purview of identity systems that could cause audit problems.

Discover how Veza can help your organization demonstrate continuous compliance with SOX faster.