Executive Summary

The European Union’s Digital Operational Resilience Act (DORA), taking effect January 17, 2025, represents a significant shift in how financial organizations must approach Information and Communication Technology (ICT) security and operational resilience. As financial firms face increasing cyber threats and digital dependencies, DORA establishes a comprehensive framework for risk management, incident reporting, resilience testing, and third-party oversight.

While DORA specifically applies to EU financial organizations, similar frameworks are emerging worldwide, such as the NIST Cybersecurity Framework in the US.

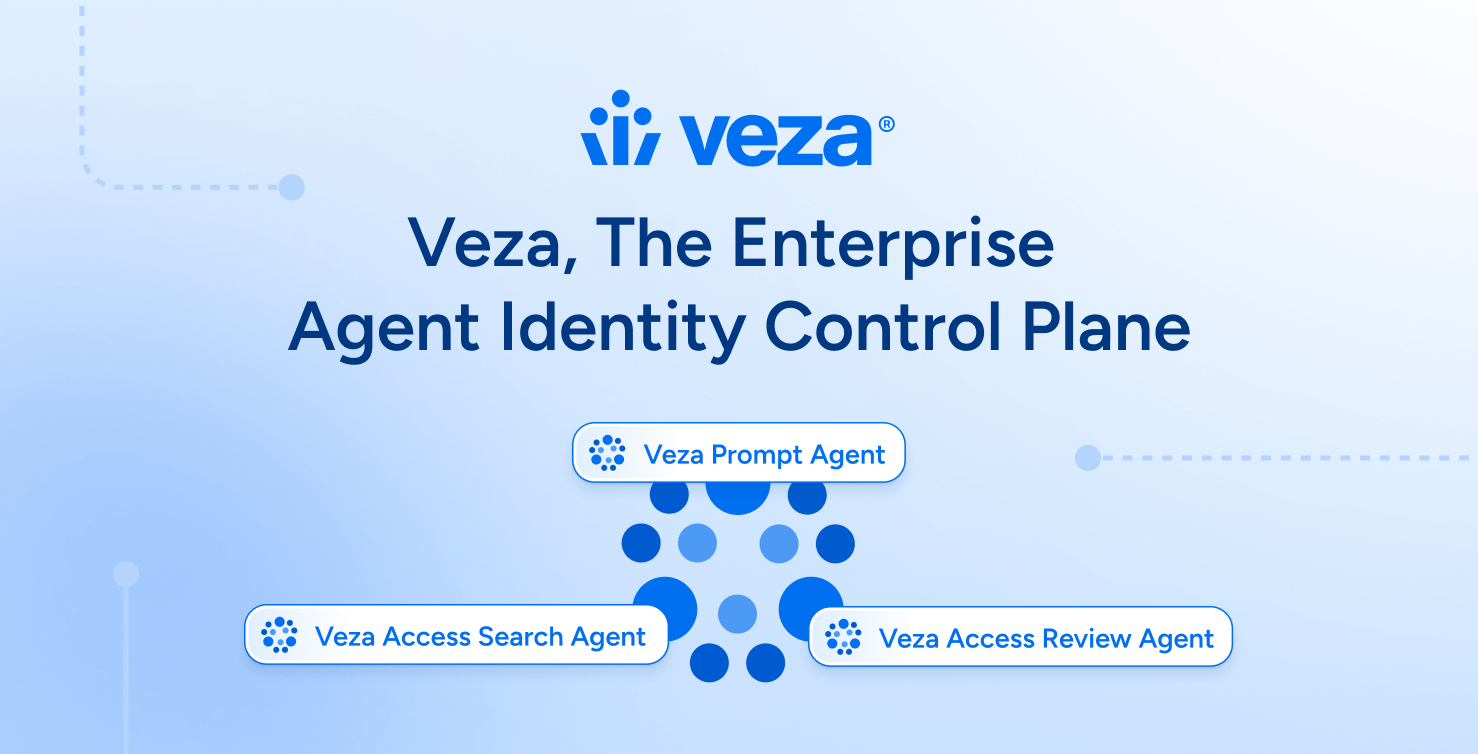

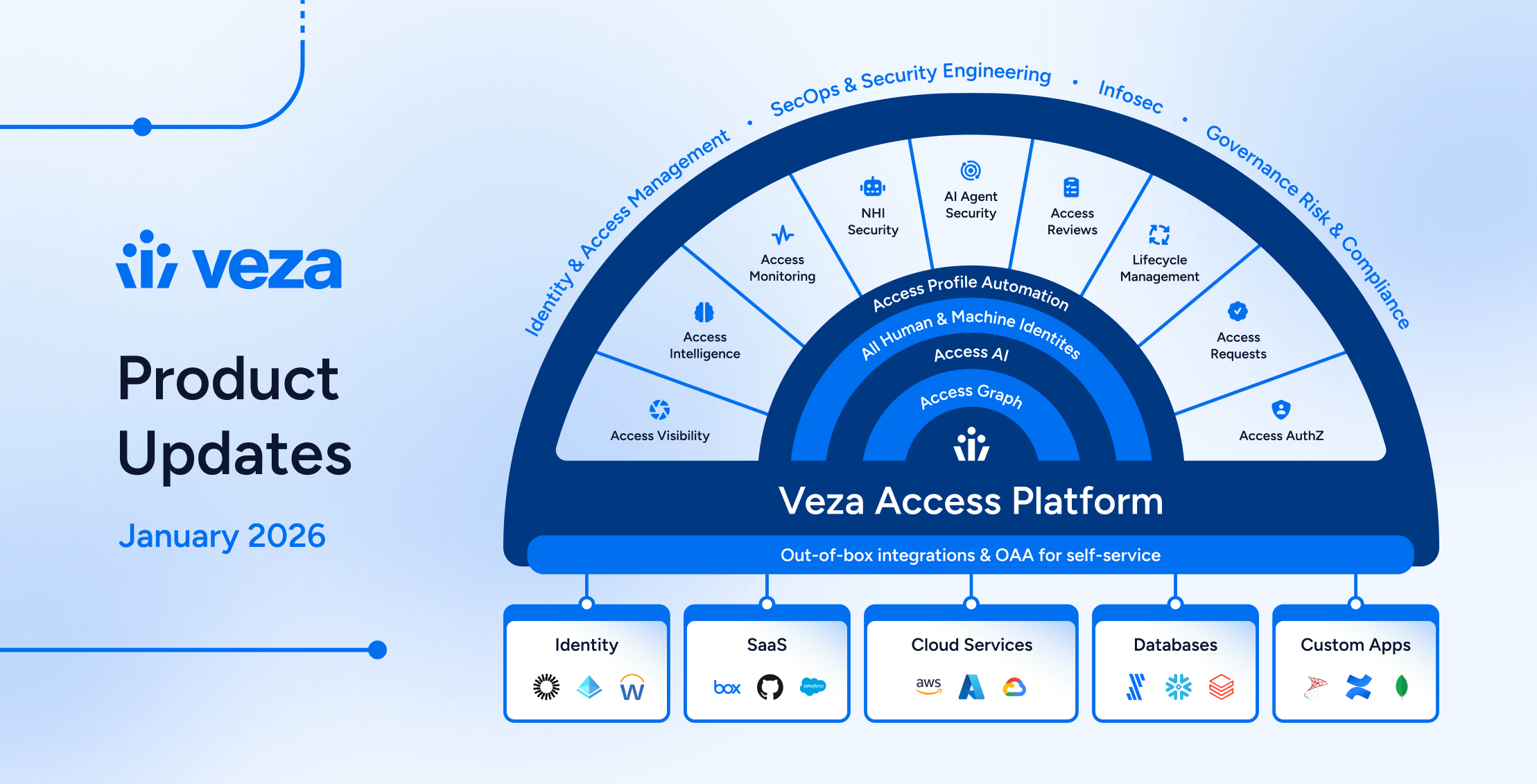

Modern identity security platforms can provide financial organizations with the capabilities needed to meet DORA’s requirements while strengthening their overall security posture. Veza’s identity security platform, through its Access Graph foundation and comprehensive control capabilities, enables organizations to maintain continuous visibility into their identity landscape, automate governance processes, and effectively manage third-party risks.

DORA Requirements Overview

DORA mandates four key pillars of compliance for financial organizations:

- ICT risk management and governance

- Incident reporting and classification

- Digital operational resilience testing

- Third-party risk management and oversight

ICT encompasses the broad range of technologies and tools used for processing and transmitting information in the financial sector. DORA focuses on ICT risks and resilience because the financial sector is critically dependent on these technologies for operations, data management, and service delivery.

DORA also applies to non-EU financial firms providing services within the EU, making it crucial for international companies to stay compliant.

For more information on DORA, the following pages offer an effective summary of requirements, potential impact, and intended scope.

- https://www.pwc.co.uk/industries/financial-services/insights/dora-and-its-impact-on-uk-financial-entities-and-ict-service-providers.html

- https://www.navex.com/en-us/solutions/regulations/dora-compliance/

The Role of Identity Security in DORA Compliance

Identity security is at the core of operational resilience and effective ICT risk management. As financial organizations increasingly rely on complex digital systems and third-party services, understanding and controlling who has access to what—and what actions they can take on resources and data—becomes critical for maintaining operational resilience.

Identity security involves ensuring that only authorized individuals can access sensitive systems and data, preventing unauthorized access that could lead to security breaches.

A robust identity security program must address three core components for DORA compliance:

- Access Governance: Organizations need continuous monitoring of access relationships, regular review and certification of access rights, and automated detection of inappropriate access patterns. This foundation ensures that access remains appropriate and documented throughout the identity lifecycle.

- Risk Management: An identity-based risk assessment approach, combined with continuous monitoring of access behaviours, enables early detection of potential security incidents. This proactive stance helps organizations meet DORA’s risk management requirements while reducing manual oversight burden.

- Third-Party Access Control: Precise control over external party access, continuous monitoring of vendor privileges, and automated policy enforcement form the backbone of effective third-party risk management under DORA.

Implementing Identity Security for DORA Compliance

Modern identity platforms like Veza approach DORA compliance through several key capabilities:

Access Intelligence

The foundation of effective compliance lies in maintaining a unified view of identity relationships across the organization’s digital ecosystem. By creating a dynamic, real-time map of all permissions and access paths, organizations can understand who has access to what data and how that access was granted – a fundamental requirement for maintaining operational resilience under DORA.

Access Intelligence refers to the real-time mapping of all permissions, providing visibility into how and where access is granted across systems and applications.

Risk Management Through Continuous Monitoring

Effective risk management requires transforming periodic assessments into continuous, automated processes. Modern platforms maintain constant surveillance over access patterns, detecting anomalies that could indicate security risks before they escalate into reportable incidents.

For instance, if an employee suddenly accesses a large amount of sensitive data, the system flags the behaviour for review, alerting the security team before any breach occurs.

Automated Governance in Practice

Modern identity platforms implement sophisticated governance workflows that align with DORA’s requirements. These automated processes initiate access reviews based on risk levels, route them to appropriate stakeholders, track progress, and maintain comprehensive audit trails.

For financial organizations managing complex systems and numerous third-party relationships, this automation ensures consistent policy enforcement while significantly reducing administrative overhead.

Third-Party Risk Management

DORA places particular emphasis on third-party risk management, requiring organizations to maintain robust oversight of their service providers. An effective identity security approach addresses this through:

- Continuous Monitoring: Real-time visibility into third-party access patterns enables rapid detection and response to potential security threats. This ongoing surveillance helps organizations maintain compliance with DORA’s third-party oversight requirements.

- Access Lifecycle Management: Automating the entire lifecycle of third-party access, from initial provisioning through regular reviews to deprovisioning, ensures that vendor access remains appropriate and documented throughout the relationship.

- Risk-Based Controls: Implementation of precise controls based on vendor risk profiles automatically enforces stricter monitoring and approval requirements for high-risk vendors or critical systems.

Implementation Strategy

Successfully implementing identity security for DORA compliance requires a strategic approach that balances immediate compliance needs with long-term operational resilience goals. Organizations should consider the following implementation phases:

1. Discovery and Assessment

Begin with a comprehensive discovery phase to map existing identity relationships and access patterns. This baseline assessment helps identify immediate compliance gaps and priorities for remediation. During this phase, organizations often uncover hidden access paths and inheritance patterns that require attention.

2. Phased Implementation

Rather than attempting a complete overhaul, implement identity security capabilities in phases aligned with DORA’s key requirements. Start with core visibility, monitoring, and intelligence capabilities, then progressively add advanced risk management features and automated governance. This approach allows organizations to build confidence and expertise while maintaining operational stability.

3. Integration and Automation

Integrate identity security controls with existing security and compliance tools to create a unified control environment. This integration enables automated workflows that reduce manual effort while ensuring consistent policy enforcement across the organization’s technology stack.

4. Measuring Success and Maintaining Compliance

Success in DORA compliance is not a one-time achievement but an ongoing process. Organizations should establish clear metrics and monitoring capabilities to measure and maintain their compliance posture. This includes:

- Regular assessment of key risk indicators through real-time compliance dashboards

- Analysis of access pattern trends and policy violations

- Automated compliance reporting for stakeholder review

- Continuous validation of control effectiveness

The Future of DORA Compliance

As regulatory requirements evolve and technology landscapes become more complex, organizations need a flexible and scalable approach to compliance. Modern identity platforms continue to evolve, offering regular updates that reflect regulatory changes, extensible integration capabilities for new technologies, and scalable architectures supporting growing organizational needs.

Conclusion

Meeting DORA’s requirements represents both a challenge and an opportunity for financial organizations. By implementing comprehensive identity security controls, organizations can transform compliance from a burden to a strategic advantage. The right identity security platform provides the visibility, automated governance, and sophisticated risk management capabilities needed not only for DORA compliance but also for overall operational resilience.

The right identity security platform helps organizations manage access risks, improve operational efficiency, and maintain strong security measures that go beyond compliance.

Success in this journey requires selecting tools that align with your organization’s specific needs while providing the flexibility to adapt to evolving regulatory requirements. With data-driven and intelligent platforms such as Veza, the key lies in building a sustainable approach that combines strong technical capabilities with practical operational processes.

Organizations that successfully implement these controls gain not just compliance but enhanced security posture, improved operational efficiency, and greater confidence in their ability to manage access risks in an increasingly complex digital landscape.