Introduction

Financial services companies are under constant pressure to protect their customers’ sensitive data and maintain compliance with the Payment Card Industry Data Security Standard (PCI DSS). With the release of PCI DSS 4.0 in March 2022, organizations must navigate a complex set of requirements and evolving threats to ensure the security of cardholder data. Failure to comply can result in significant fines, reputational damage, and loss of customer trust. However, with Veza’s modern Identity Security platform, financial services companies can streamline their compliance efforts and achieve a more robust security posture.

The Challenges of PCI DSS Compliance

Achieving and maintaining PCI DSS compliance is no easy feat. According to the Verizon Payment Security Report, only 27.9% of organizations maintained full compliance with PCI DSS in 2019. This improved in 2020, with 43.4% of organizations maintaining full compliance, but these numbers still demonstrate that many organizations are still struggling. The complexity of the standard, coupled with the ever-evolving threat landscape, makes it difficult for financial services companies to keep up.

One of the most significant challenges is implementing strong access control measures, which is covered under PCI DSS Requirement 7. Organizations must ensure that access to cardholder data is restricted to only those individuals who need it to perform their job functions. This requires a granular approach to access management and the ability to enforce least privilege access across all systems and applications.

How Veza Enables PCI DSS Compliance

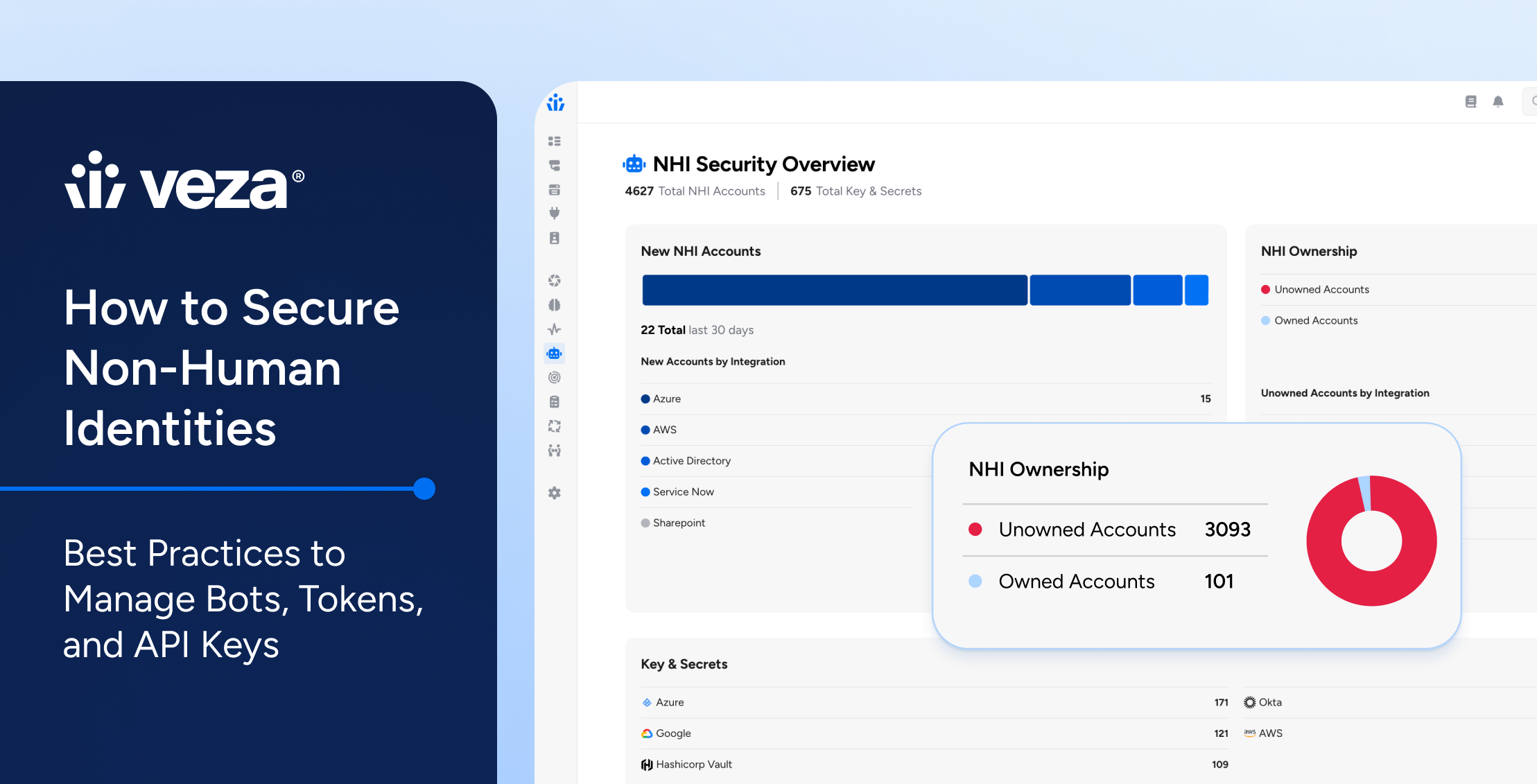

Veza’s Identity Security platform empowers financial services companies to tackle the challenges of PCI DSS compliance head-on. By providing a unified platform for identity security and access governance, Veza enables organizations to gain complete visibility into who has access to what data across their entire infrastructure, including cloud environments, SaaS applications, and databases.

- Implementing Strong Access Control Measures (PCI DSS Requirement 7) – Veza simplifies the process of implementing strong access control measures by enabling organizations to enforce least privilege access. With Veza, security teams can easily define and manage granular access policies based on user roles and responsibilities. By monitoring and alerting on high-risk or non-compliant permission combinations, and automating access provisioning and deprovisioning processes, Veza reduces the risk of unauthorized access and helps maintain a secure environment.

- Demonstrating Compliance (PCI DSS Requirement 12) – Demonstrating compliance is a critical aspect of PCI DSS, and Veza makes it much more straightforward. With Veza’s centralized identity governance capabilities, financial services companies can generate comprehensive compliance reports and audit trails, reducing the time and effort required to prepare for assessments and audits. Veza’s out-of-the-box connectors and API-first architecture enable seamless integration with existing systems, minimizing integration costs and complexity.

- Maintaining Continuous Compliance (PCI DSS Requirement 11) – Maintaining compliance with PCI DSS 4.0 requires continuous monitoring and testing of networks and systems. Veza’s ML/AI-based access intelligence provides proactive risk mitigation, alerting security teams to potential threats and anomalies in real-time. By automating access reviews and reconciliation processes, Veza helps organizations maintain a secure and compliant environment without disrupting business operations.

Additional PCI DSS Requirements Addressed by Veza

In addition to the core requirements mentioned above, Veza also helps financial services companies address other key aspects of PCI DSS compliance:

- Monitoring Multi-Factor Authentication (MFA) (PCI DSS Requirement 8) – Veza’s platform can monitor if MFA is disabled or not applied to certain users accessing high-risk or regulated systems. This visibility helps organizations ensure that MFA is consistently enforced and enables them to take corrective action when necessary.

- Containing the Blast Radius of Malware and Ransomware (PCI DSS Requirement 5) – Veza’s platform can help contain the blast radius of disruptive or destructive malware threats by enforcing least privilege access. By limiting user access to only the resources they need, Veza minimizes the potential impact of a malware or ransomware attack, reducing the risk of widespread data compromise.

Conclusion

Achieving, demonstrating, and maintaining compliance with PCI DSS 4.0 is a complex and ongoing process for financial services companies. However, with Veza’s modern Identity Security platform, organizations can streamline their compliance efforts, reduce costs, and ensure the security of their customers’ sensitive data. By providing a unified platform for identity security and access governance, Veza enables financial services companies to focus on their core business objectives while maintaining the trust and confidence of their customers. As the PCI Security Standards Council continues to evolve the standard to address emerging threats and technologies, Veza will remain a valuable partner in helping financial services companies navigate the ever-changing landscape of PCI DSS compliance.